Discover the Fides Currency Framework

fides

fi·des | ˈfē-ˌdās | noun

1 : faith, trust, reliability

2 : the backing of currency by the shared productive capacity and voluntary trust of citizens, as in Fides CurrencyFides Currency redefines value not through decree (fiat) or scarcity (gold), but through collective trust in the productive capacity of citizens—the only asset that compounds with human flourishing. As Alexander Hamilton noted in 1790, ‘the public credit must be maintained inviolate’; this model fulfills that by making citizens the direct creditors, ensuring interest flows proportionally to those who back it (31 U.S.C. § 3101).

Discovering the Fides Currency System

Explore an in-depth explanation of Fides Currency’s innovative approach, its foundation rooted in economic theory, and how it empowers citizens by linking national debt benefits directly to the public through a Treasury-backed framework.

Understanding the Fides Currency Legislation

Explore clear, straightforward answers to key questions about Fides Currency to guide your learning journey.

How does the Fides Currency system work in practice?

Every citizen gets a free Treasury-backed debit card. All balances earn the full Treasury yield with no bank skim, and capped swipe fees fund credits and debt retirement.

Is this card a CBDC?

No. It is a direct TreasuryDirect account with a debit card, not a central-bank digital currency and cannot be programmed or restricted.

How is the system funded?

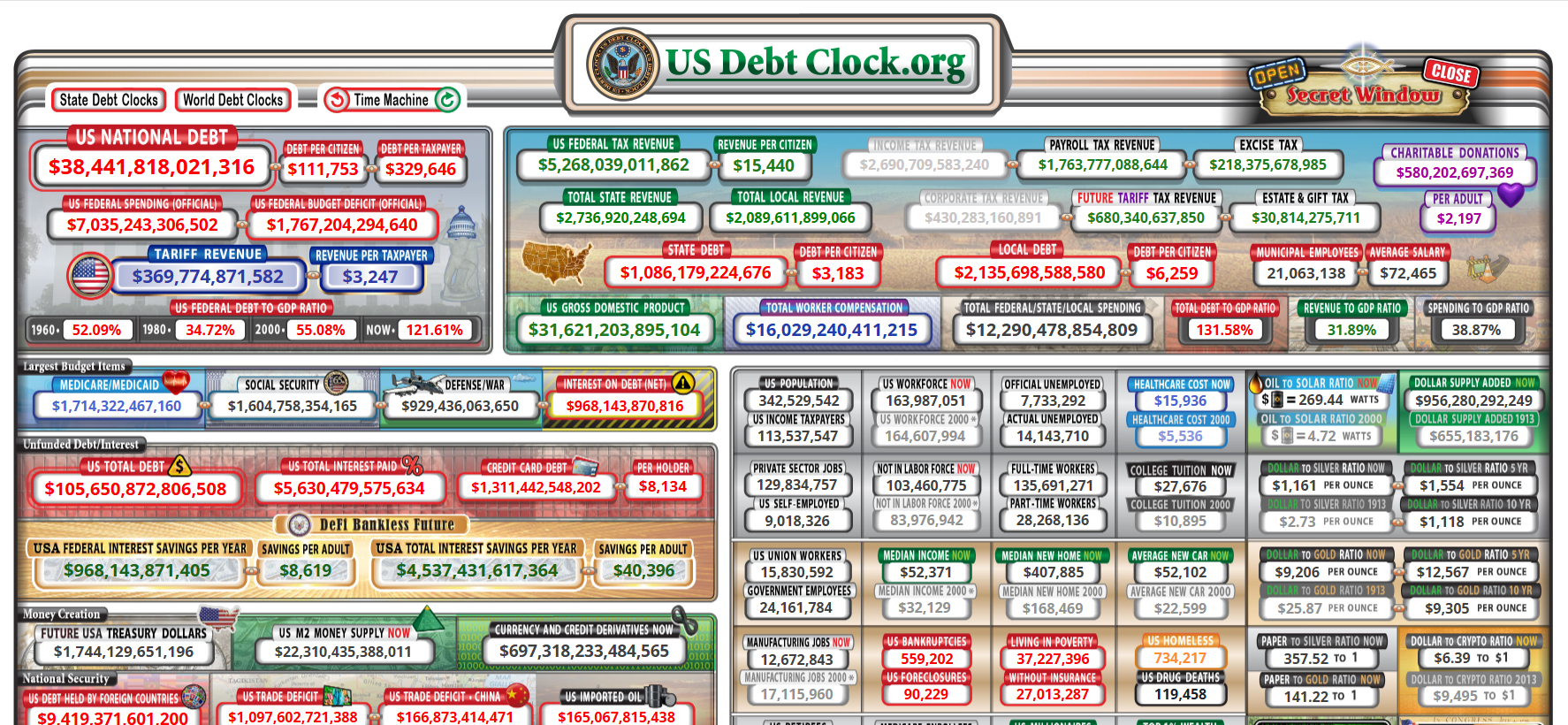

By recapturing existing bank spreads and excess swipe fees — roughly $500 billion a year currently taken by banks — with no new taxes or spending.

Why do citizens own the national debt?

The debt is issued under the full faith and credit of the United States. That credit belongs to the citizens who pay the taxes that service it.

Does this hurt banks?

Banks become paid servicers (0.1 % max fee) and keep only customers who want a relationship. They lose the free skim but gain stability and new revenue.

Is this constitutional?

Yes. It uses only existing Treasury authority (31 U.S.C. § 3101 et seq.) and the same “full faith and credit” language already on every Treasury bond.

How soon could this start?

Day one after passage. The card uses existing EBT rails, TreasuryDirect, and postal locations — rollout begins within 180 days.

How is the system funded?

This reclaims rents on citizen-backed credit (Piketty’s r > g dynamic), ensuring equity without coercion.

Blog

Explore a collection of articles and resources that explain Fides Currency’s innovative economic model and its impact on society.

-

Is the United States a Capitalist Country?

The short answer is no. We haven’t been capitalist by the classical definition since…

-

Why would I want to own the National Debt?

This is perhaps the most important question to dissect when discussing Fides Currency. We…

-

The American Prosperity Card Act – Full Text & Summary

The American Prosperity Card Act is a short bill that does three simple things:…

Discover How Citizens Gain from National Debt

Learn about the innovative Treasury-backed system that empowers citizens through direct economic benefits.

Direct Citizen Benefits

Understand how the model allows individuals to share in national wealth, enhancing economic participation and security.

Transparent Legislative Framework

Explore clear, non-partisan legislative details that support and regulate this progressive economic approach.

Accessible Educational Resources

Delve into historical context and economic insights presented in an easy-to-understand manner for all audiences.

Discovering the Treasury-Backed Economic Model

- Legal Root: Fides is backed by the Constitution by ensuring the government function is of, by and for the people

- Philosophical Root: Fides (Latin for trust) contrasts fiat’s decree with citizen-backed value, per Hamilton’s 1790 public-credit mandate.

Please reach out with any feedback or questions about the model. I am always up for suggestions on how to make the model better or any ideas you may have about future possibilities under it.